The housing market will be a hot topic in 2026, with social media buzzing about skyrocketing home prices, whispers of a potential crash, and comparisons to the 2008 financial crisis. Homebuyers are hesitant, wondering if they’ll overpay at the peak. Homeowners worry about their property values. Investors are on edge, trying to predict the next big shift. The fear is real, but so is the confusion. Is a crash coming, or is this just market noise?This article cuts through the speculation with expert insights and practical advice.

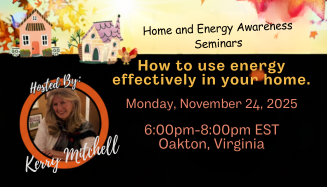

Our goal is to help you make informed decisions, whether you’re buying, selling, or investing. That’s why programs like the Real Estate Consumer Training Programs and Home and Energy Awareness Seminars are empowering people with real data, not panic, to navigate today’s complex market with confidence.

What Experts Are Saying About the 2026 Housing Market

Despite the doomsday chatter, most housing economists predict stability or a mild correction in 2026, not a catastrophic crash. Unlike the 2008 crisis, today’s market is underpinned by stronger fundamentals. Homeowner equity is at historic highs—over 50% of homes are mortgage-free or have significant equity, according to recent data. Lending standards are also far stricter, with subprime loans nearly nonexistent compared to the pre-2008 era.

The consensus among experts, including those from the National Association of Realtors and Zillow, is that a true “crash” requires two key ingredients: an oversupply of homes and widespread risky lending. Neither is present today. While inventory is growing slightly, it’s nowhere near the glut of the mid-2000s, and banks are cautious about who they lend to.

Takeaways: Understanding these fundamentals is exactly what Real Estate Consumer Training Programs teach you—how to read market data, spot opportunities, and protect your investment. These programs break down complex trends into actionable insights, so you can move forward with confidence.

The Market Signals You Should Actually Watch

To make smart decisions, focus on the data points that matter most. Here are the key signals shaping the 2026 housing market:

- Mortgage Rates: Rates remain high but are stabilizing, with the Federal Reserve hinting at potential cuts in 2026. Lower rates could boost buyer demand, especially in affordable regions. Keep an eye on how rate changes affect your local market.

- Inventory Growth: New listings are up slightly, giving buyers more options. However, inventory remains below pre-pandemic levels in most areas, keeping competition alive in hot markets.

- Affordability Pressure: Home prices have outpaced wage growth in many regions, squeezing first-time buyers. Watch how local wages compare to home prices in your area to gauge affordability.

- Lending Practices: Unlike 2008, today’s loans require solid credit and income verification, reducing the risk of mass defaults.

By learning to interpret these signals, you can make informed choices. Real Estate Consumer Training Programs teach you how to analyze these data points, empowering you to spot opportunities and avoid pitfalls in any market condition.

Why This Isn’t 2008 All Over Again

The 2008 housing crash was triggered by a perfect storm: reckless lending, speculative overbuilding, and rampant subprime mortgages. Borrowers with little income could secure loans with no down payment, leading to a wave of defaults when the bubble burst. Add in an oversupply of homes, and prices plummeted.

Today’s market is fundamentally different. Lending standards are rigorous, with banks requiring higher credit scores and down payments. Homeowner equity is robust—CoreLogic reports that U.S. homeowners have over $15 trillion in equity, a buffer against price drops. Foreclosure rates are also near historic lows, with less than 0.4% of mortgages in foreclosure as of mid-2025.

Expert Insight: As Dr. Lawrence Yun, Chief Economist at the National Association of Realtors, notes, “The housing market today is built on a much stronger foundation than it was in 2008. We’re seeing disciplined lending and steady demand, not speculative frenzy.

Plug: These insights are covered in the Real Estate Consumer Training Program’s Guide to Understanding Market Cycles module—a must for anyone planning to buy, sell, or invest in 2026. It equips you with the tools to understand what drives markets and how to act wisely.

What Could Still Trigger a Slowdown

While a full-blown crash is unlikely, risks remain. Here are potential factors that could slow the market:

- High Interest Rates: If rates stay elevated or rise further, affordability could worsen, cooling demand.

- Inflation Spikes: Persistent inflation could erode purchasing power, especially for first-time buyers.

- Unemployment Upticks: A sudden rise in joblessness could reduce buyer confidence and lead to fewer transactions.

Importantly, real estate is local. Cities like Austin or Miami, with strong job markets, may continue to see price growth, while areas with weaker economies could face declines. National headlines often miss these nuances, so focus on your region’s data.

Connection: Our Home and Energy Awareness Seminars dive deeper into how energy-efficient homes can retain higher market value, even during slowdowns. By making smart upgrades, like adding solar panels or improving insulation, homeowners can future-proof their investments against market shifts.

What Buyers Should Do in 2026

Waiting for a “crash” to buy a home is a risky strategy. Prices may not drop significantly, and competition could intensify if rates fall. Instead, focus on preparation:

- Assess Your Finances: Check your credit score, save for a down payment (aim for 10–20%), and get pre-approved for a mortgage to understand your budget.

- Research Local Markets: Prices and inventory vary widely by region. Use tools like Zillow or Redfin to track trends in your area.

- Educate Yourself: Real Estate Consumer Training Programs teach you how to assess property values, compare mortgage options, and negotiate deals. You’ll learn to spot undervalued properties and avoid overpaying.

What Sellers Should Know Before Listing

With inventory creeping up, sellers face more competition in 2025. Pricing your home correctly is critical—overpricing can lead to months on the market. Work with a realtor to analyze recent sales in your area and set a competitive price.

Sustainable upgrades can also set your home apart. Energy-conscious buyers are increasingly drawn to homes with features like solar panels, smart thermostats, or high-efficiency windows. These improvements not only reduce utility bills but also boost your home’s appeal.

If you’re thinking of selling, the Home and Energy Awareness Seminar can help you understand how eco-friendly improvements save energy and increase your property’s market value. Learn how to market your home as a green, cost-saving option for buyers.

The 2025–2030 Housing Outlook: Gradual Normalization

Looking ahead, experts forecast slower but steady home price growth—around 1–3% annually through 2030. Strong job markets in states like Texas, Florida, and California’s tech hubs will likely see continued demand, while rural or economically stagnant areas may flatten. A major trend is the rise of energy-efficient, sustainable housing, driven by buyer demand and new building codes.

The market is shifting toward normalization, with fewer bidding wars and more balanced negotiations. This is good news for buyers and sellers who are prepared.

Conclusion: Knowledge Is the Real Investment

The 2025 housing market is not heading for a crash—it’s stabilizing. While risks like high rates or economic shifts exist, the fundamentals are strong, and opportunities abound for those who are prepared. Instead of succumbing to fear, focus on education and strategic planning.